The headline unemployment charge per unit of measurement gets almost all of the attention, but the U.S. Bureau of Labor Statistics too publishes the results of the

Job Opening as well as Labor Turnover Survey (JOLTS), which gives to a greater extent than especial on underlying patterns of hiring as well as firing. The

JOLTS numbers for Dec 2013 came out on Tuesday, as well as hither are a few of the highlights that caught my eye.

One useful mensurate of the dry reason of the labor marketplace is the issue of unemployed people per undertaking opening. After the 2001 recession this ratio reached nearly 3:1, as well as during the worst of the Great Recession in that location were nearly seven unemployed people for every undertaking opening. But past times Dec 2013, the ratio was dorsum downward to 2.6--not quite equally salubrious equally 1 would like, but withal a vast improvement.

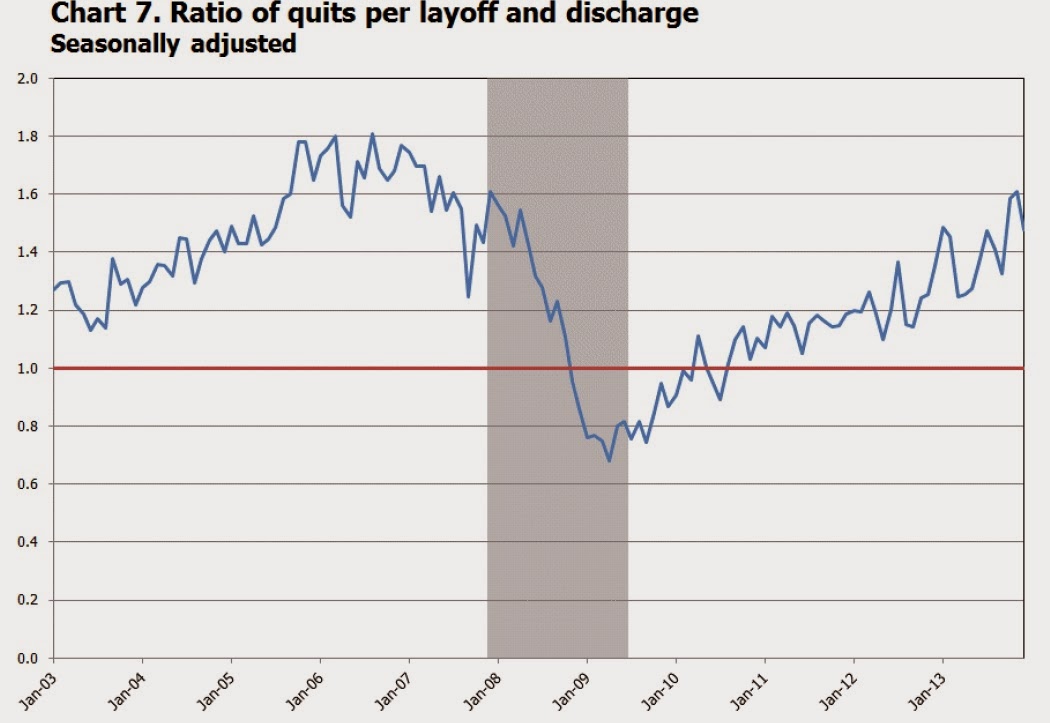

Another mensurate is the ratio of quits to layoffs/discharges. Quits are when a mortal leaves a undertaking voluntarily. Layoffs as well as discharges are when people are separated from their undertaking involuntarily. In a salubrious economy, to a greater extent than people quit than are forced to leave, hence the ratio is higher upwards 1. In the recession, voluntary quits dwindled equally people held onto the jobs they had, as well as involuntary layoffs rose, hence the ratio vicious below 1. We convey directly returned to an economic scheme where those who operate out their jobs are to a greater extent than probable to convey done past times quitting voluntarily than past times beingness pose off or discharged involuntarily

Finally, the Beveridge curve shows a human relationship betwixt undertaking openings as well as unemployment inwards an economy. The park blueprint is that when undertaking openings are few, unemployment is higher, as well as when undertaking openings are many, unemployment is lower. As the illustration shows, the information for the U.S. economic scheme sketched out this sort of Beveridge bend equally the 2001 recession arrived, equally the labor marketplace recovered, as well as and hence equally the Great Recession hit. But since the recession ended, the U.S. economic scheme has non moved dorsum upwards the same Beveridge curve. Instead, the information since the terminate of the recession is tracing out a novel Beveridge bend to the correct of the previous one. The shift inwards the Beveridge bend agency that for a given grade of undertaking openings (shown on the vertical axis) the corresponding unemployment charge per unit of measurement (shown on the horizontal axis) is higher. This effect is ofttimes described equally maxim that the economic scheme isn't doing equally skillful a undertaking of "matching." But equally the BLS writes: "For example, a greater mismatch betwixt available jobs as well as the unemployed inwards price of skills or location would crusade the bend to shift outward, upwards as well as toward the right."

The JOLTS study only reports these statistics, as well as isn't well-nigh analyzing the possible underlying causes for such a mismatch.

Here is a weblog post service from August 2012 about additional background on Beveridge curves, historical patterns, as well as their application to the U.S. economic scheme inwards recent years.

Terimakasih anda telah membaca artikel tentang Lesser Known Improvements inwards the U.S. of A. Labor Market. Jika ingin menduplikasi artikel ini diharapkan anda untuk mencantumkan link https://venturcapital.blogspot.com/2017/09/lesser-known-improvements-inwards-us-of.html. Terimakasih atas perhatiannya.